Circular economy opportunities in Canada

Canada is the second largest country in the world and a major world economy. The country’s wealth has historically depended on the exploitation of its abundant raw materials and local energy sources, in particular hydropower. As the effects of climate change threaten Canada’s territory and population, the national government and local businesses have set goals and standards to implement a circular economy and become climate neutral by 2050.

Interested in discovering more about circular business opportunities in Canada? Below you will find an overview of the country’s policy landscape, circular economy strategies, and 3 selected priority sectors: buildings & infrastructure, agrifood & food waste management, and plastics & solid waste management.

Facts & Figures

Economic Indicators

- Size: 10 million square kilometres

- Population (2021): 38,3 million

- Nominal GDP & Ranking (2021): $2.02 billion – #9

- Export value of products (2021) $503.7 billion (of which $2.89 billion to the Netherlands)

- Import value of products (2021) $489.6 billion (of which $4.38 billion from the Netherlands)

- Economic growth (2020): 5.3%

- Purchasing Power (2021): $1.253

- Ease of doing business rank (2020): #23

- Corruption perception index (2021): 74/180

- Unemployment rate (2022): 5.1%

- Currency: Canadian Dollar

- Time difference NL: -6 hours (Amsterdam – Ottawa)

Circular economy indicators

- Global Innovation Index (2021): #16

- Share of electricity production from non-emitting Resources: 83% (including solar, wind, nuclear and water)

- Installed Wind Energy Capacity World Rank (2020): #9

- Plastics Recycling Rate (2019): 12%

National Policy Landscape

Canada has embraced the challenge of climate change as an opportunity for sustained green growth in the long-term. Following the ratification of the Paris Agreement in 2016 and the subsequent introduction of the Pan-Canadian Framework on Clean Growth and Climate Change (2016) and Strengthened Climate Plan (2020), the federal government has set the goal to significantly reduce Canada’s environmental impact and become climate neutral by 2050.

Other relevant environmental goals include:

- Requiring all plastics packaging to have a 30% recycled content by 2025

- Phasing out coal-fired electricity by 2030

- Running all government operations at net-zero emissions by 2050

The government sustainability strategy includes plans to make the country a global leader in clean energy and technology, which represent two key sectors for Canada’s economic wealth. Energy represents 10% of the national GDP, but its use and production account for over 80% of the country’s carbon emissions. Although the Canadian energy system is already one of the cleanest in the world, the potential for improvement is great. The federal government is thus investing heavily to increase national energy efficiency especially in industry, transport and buildings. Relevant programs include loans and funds for home energy retrofits, energy efficient new buildings, and energy-saving improvements for municipal buildings, with a focus on low-carbon and circular materials and clean technologies.

With the goal of abating waste, Canada has introduced policies and initiatives to specifically tackle plastics pollution and food waste by recovering value across these supply chains. The Strategy on Zero Plastic Waste and Action Plan was introduced in 2018 to promote a circular economy for plastics and is now in its second phase. Organic waste is also targeted as a major source of methane emissions and economic loss via the Food Waste Reduction Challenge. This financial program primarily supports innovations aimed at reducing, repurposing and avoiding food waste from farm to table.

The future is circular. So let’s collaborate on making sustainable innovations in Canada and the Netherlands everyday practice and begin the shift to a more circular economy – together!

Consulate General of the Kingdom of the Netherlands in Toronto

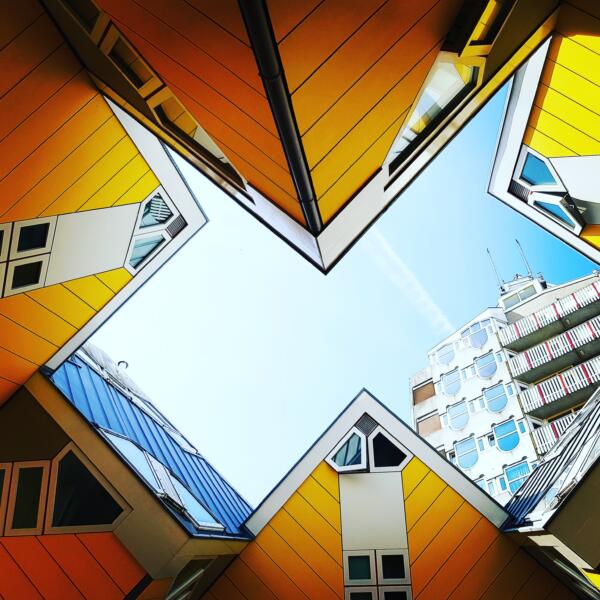

Circular Construction

The construction sector is major driver of Canada’s economy, generating over $ 140 billion of the country’s GDP (2020). However, the sector is responsible for 1/3 of all solid waste, other than being extremely energy- and resource-intensive. Only houses and buildings account for 13% of total carbon emissions in Canada. In the last two decades, several standards and certifications for a greener built environment were thus adopted, with a focus on buildings durability and design for reuse.

This sector presents great opportunities for circular innovation across its entire value chain. National efforts include prioritising low-carbon and renewable building materials and in particular timber, since Canada is a major producer of wood. Recycled plastics are also being deployed in the production of furniture, decking, fences and interior textiles like carpets. Local expertise in prefab buildings and modular construction is also increasing, representing a promising opportunity for business collaborations. Increasing raw material prices are also gradually driving demand for recovered materials such as timber from demolished buildings.

The development of circularity in the sector varies greatly by province and region. British Columbia, Quebec and Ontario are currently leading the circular construction transition at provincial level via targeted initiatives and support to business innovations. For example, the City of Vancouver mandated that 75% of all materials from homes built before 1950 and one- and two-family homes be recycled after demolition already in 2014 to support resource recovery.

Circular Economy Leadership Canada is currently driving several projects to foster circularity in Canadian construction, including supporting the development of a roadmap and action plan for the built environment sector, coordinating experimentation on cement recycling and reuse, and nation-wide life cycle extension projects for buildings. The Consulate General of the Kingdom of the Netherlands in Toronto initiated the Dutch Canadian Circular Alliance, a bilateral platform that facilitates exchange of knowledge and best practices in the Circular Economy, the network includes many Dutch and Canadian companies working in the construction and urban planning sectors.

Agriculture and Food Waste Management

Canada is a world exporter of agrifood products, with 1/8 local jobs being related to the food system. The agriculture industry is responsible for a considerable amount of the country’s emissions and environmental impact and has already started to invest in cleaner and more sustainable innovations to also improve its resilience to climate change. National initiatives and targets include a more efficient and safer use of fertilisers, and considerable investments into climate-smart agriculture technologies, for example through the Canadian Agricultural Partnership.

Attention is also paid to diversifying farmer’s revenue streams. One avenue is harvesting feedstock for biofuels productions. Another comprises the alternative uses of crop residues or manure for the bio-based products sector, such as for bio-based chemicals for household cleaning products, and the employment of agricultural waste for bioenergy production to supply locally. In this area, innovative business models such as entrepreneurial co-operatives can play a pivotal role in bringing about the necessary change.

The federal government has also undertaken a 5-year plan to invest over $26 million in initiatives that help reduce food waste and thus cut greenhouse gas emissions. Recent estimates showed that more than 50% of the Canadian food supply ends up as waste, with a loss of around $50 billion in avoidable food waste and considerable methane emissions as a result. Scaling biowaste-to-energy business models is seen as a particularly promising way to both tackle food waste and reduce emissions from electricity generation. Other areas for fruitful business collaborations include improved packaging design for longer shelf life and technologies to reduce the amount of discarded food as a result of inefficient food processing techniques in factories.

Plastics and Waste Management

The increasing amounts of landfilled waste in Canada represent a considerable source of methane emissions, which federal and local governments are now specifically tackling. With the Strategy on Zero Plastic Waste, the goal of decreasing waste by 50% by 2040 was introduced. Efforts to divert products and materials from landfills are primarily aimed at promoting reuse, repair and refurbishment activities. In particular, goods such as clothing, furniture, electronics and household appliances are at the core of the nation-wide value-retention promotion programs. As these processes are estimated to be worth CAN$ 56 billion annually, Canada is preparing a targeted national strategy to support the growth in this sector.

The plastics production industry in Canada is a major economic sector, worth $35 billion in revenue. The country disposes of 3 million tons of plastics annually, of which around half is packaging. With only around 12% of disposed plastics currently being recycled, the potential for circular innovation in the sector is enormous. Thrown away plastics are forecasted to become an $11 billion industry by 2030. To drive the circular transition in the sector, the Canada Plastics Pact Roadmap was launched in collaboration with multiple value chain stakeholders from the public and private sectors. Amongst others, the Pact aims at recycling or composting 50% of plastics packaging and at 30% recycled components in all plastics packaging by 2025.

The solid waste management and plastics sectors present multiple opportunities for Dutch innovators to contribute to the circular transition. At government level, priority is given to the promotion of innovations and business models for plastics avoidance, reduction or substitution from the design phase, and for improved collection, sorting and recovery techniques at the end of each lifecycle. In particular, Dutch businesses active in enhancing plastics recyclability, innovating (food) packaging design and materials, and improving the quality and reusability of recycled plastics could find good grounds for expansion in Canada.

Relevant networks

Business Networks

- Circular Innovation Council

- Canada Green Building Council

- Canada Circular Hotspot

- Québec Circulaire

- National Zero Waste Council (NZWC)

- Dutch Canadian Circular Alliance (DCCA)

Knowledge Institutes

- Pacific Institute for Climate Solutions

- Circular Economy Leadership Canada

- Smart Prosperity Institute

- The Natural Step

- Fraser Institute

- Environment & Climate Change Canada (ECCC)

Embassies & Related Organisations

Useful Reports & Links

- Market Study on Food and Food Waste Management in Canada

- Circular Economy and the Built Environment Sector in Canada

- A Circular Economy for Plastics in Canada

- Turning Point: The Expert Panel on the Circular Economy in Canada

- Metro Vancouver’s Construction and Demolition (C&D) Waste Reduction and Recycling Toolkit

- Canada Plastics Pact Roadmap

- Biofuels in Canada 2022

- Waste Prevention: The Environmental and Economic Benefits for Canada

Upcoming Events

- Interior Design Show 2023 in Toronto

- Interior Design Show 2023 in Vancouver

- Canadian Waste to Resource Conference

- Value of Biogas East

- Canadian Greenhouse Conference

- PDAC 2023

- Buildings Show 2023

- Collision

- Circular Economy Hotspot Event in Canada, 2024 (watch this page for updates!)

Webinar: Circular Plastics in Canada and the Netherlands

Opportunities, Best Practices & Policy Approaches for Circular Plastics

A Circular Economy for Plastics in Canada & the Netherlands

Online | 5th of April 2023

An interactive session on Circular Plastics & NL/CANADA collaborations

CE Hotspot movement further pushing boundaries in 2024

In 2024 four CE Hotspot events around the globe will be organized

Open Call for CE Hotspot 2024

Expression of interest for CE Hotspot 2024

NBSO Americas Dialogues

online | 15th of June 2022

Supporting NL Entrepreneurs doing business in the Americas

Canada market report, on food production, waste and waste management (including packaging)

online | 9th of March 2022

Market Study on Food and Waste Management in Canada

The Netherlands & Canada: transitioning to a circular economy

Dutch-Canadian efforts towards circular economy

The Circular Approach to Building Buildings

online | 11th of May 2021

Dutch and Canadian circular construction approaches and best practices

Waste management and circular economy

online | 10th of March 2021

When waste is not waste.

WCEF2021

Toronto, Canada | 13th until 15th of September 2021

World’s leading game-changers in the circular economy