Circular economy business opportunities in France

France exhibits compelling prospects for businesses interested in the circular economy. Ranked 7th in the world by GDP, boasting a strategically advantageous geographical location, and showcasing ambitious goals in circular economy and waste management, the possibility of fruitful collaboration between French and Dutch enterprises is highly promising.

Thinking about doing business in France? Scroll through an overview of facts & figures, policy landscape, selected priority areas, and relevant upcoming events and networks! OR just download the printable and compact 2-pager below!

Facts & Figures

Economic indicators

- Population (2023): 68 million

- Nominal GDP (2022): $2,936 trillion

- World rank: 7th

- Purchasing power (2021): €20,662 / inhabitant

- Export to the NL (2022): €32 billion

- Economic growth (2022): 2.6%

- Ease of doing business rank (2020): 32/190

- Corruption index (2022): 21/180

- Unemployment rate (2022): 7.1%

- Currency: Euro

- Time difference NL: +0.00 hrs

Circular economy indicators

- Municipal waste recycling rate (2020): 42,7%

- Share of energy from renewable sources (2020) 19.1%

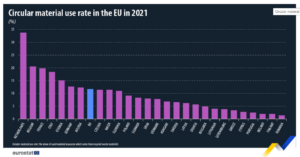

- Circular material use rate (2021): 20%

Source dataset: env_ac_cur

EU27’s material footprint (raw material use), in tonnes per person between 2010 and 2019.

(source: Eurostat)

EU Policy landscape

In March 2020, the European Commission announced the New Circular Economy Action Plan, a comprehensive plan to enhance the EU’s shift to circularity. The strategy focuses on essential topics such as waste management and reduction, sustainable production, use of resources and consumption. In February 2021, a resolution was adopted by the European Parliament calling for additional steps to escalate the region’s effort, such as stricter recycling regulations and binding targets for material use and consumption by 2030 with the objective of achieving a carbon-neutral, sustainable, and circular economy by 2050. In 2022 a new packaging regulation was created with the aim of decreasing packaging waste while enhancing packaging design, urging a switch to biobased, biodegradable, and compostable plastics. Most recently, integrating into the puzzle of legislation created to regulate the shift to a circular economy, the Critical Raw Materials Act (CRMA) was promulgated. The Regulation strives to guarantee access to the EU to a reliable and sustainable supply of essential raw minerals.

Currently relevant EU Goals include:

- Empower consumers and tackle greenwashing by ensuring the accuracy of companies’ green claims;

- Member states should restore at least 30% of habitats in terrestrial, coastal, freshwater, and marine ecosystems that are degraded by 2030;

- No foreign nation must supply more than 65% of the yearly consumption by the Union of any strategic raw material at any relevant stage of processing;

French Circular Strategy

In 2018, the Circular Economy Roadmap which outlines France’s approach to a circular economy, was unveiled. It consists of 50 actions broken down into four categories: (1) enhanced waste management, (2) improved manufacturing, (3) better consumption, and (4) stakeholders’ engagement. It entails actions such as fostering eco-design, encouraging repair and reuse, raising recycling rates, and lowering waste production. In 2020, the Anti-Waste for a Circular Economy Law (AGEC) was promulgated and it encompassed actions ranging from outlawing some single-use plastic items to setting an electric and electronic product repairability index. The new legislation put emphasis on the repairability of specific products and mandated the obligation for Producer Responsibility Organizations to support repair funds in several Extended Producer Responsibility schemes. Another development in the legal system is the Climate and Resilience Law (2023), which incorporates numerous actions relating to CE, such as environmental information on consumer products or new reporting requirements for companies and the regulation on advertising and greenwashing.

National Circular Economy Goals

• 30% reduction of resource use and consumption by 2030;

• 50% reduction of non-hazardous waste in landfills by 2025;

• 100% recycling of plastic waste by 2025;

On the Path to Reduce Single-Use Plastic Packaging

To end the marketing of single-use plastic packaging by 2040, Article 7 of the French law against waste and the circular economy (AGEC) requires France to develop two tools:

- a five-year reduction, reuse and recycling target (set by the 3R decree of April 2021);

- a 3R strategy that “defines the sectoral or general measures necessary to achieve the objectives [set by the 3R decree]”.

By 2025, the objectives are to reduce single-use plastic packaging by 20%, with at least half being reused, and to completely eliminate “unnecessary” single-use plastic packaging. Additionally, they aim to achieve 100% recycling of all single-use plastic packaging by ensuring it is recyclable and free of materials that hinder the recycling process.

Textiles and Fashion

The sustainable transition in the French fashion industry is ongoing. Since 2019, the Fashion Pact act as a cooperative strategy uniting fashion and textile businesses to work towards shared objectives on climate, biodiversity, and oceans. As part of the new EPR Roadmap (2023-2028), €1 billion will be allocated to 5 projects for the improvement of garment recycling.

The French Trade Association of the Circular Fashion Industry (FMC) is also actively promoting textile reuse and recycling. Their efforts are directed at innovation and production, consumer education and information, and taxation and working conditions. Another notable industry initiative is the Lyon-based Techtera cluster, focused on advanced materials, smart textiles, sustainable solutions, and digital technologies. It fosters collaboration, promotes research, and facilitates access to funding, markets, and international networks.

Plastics

New rules on plastic packaging to protect fruit and vegetables in France

In early 2023, the French Ministry of Ecological Transition came up with a new text banning the sale of fruit and vegetables in plastic packaging, after the French Council of State declared the decree published on 12 October illegal in late 2022. The new text appears to relax retail sales of fresh fruit and vegetables in plastic packaging compared to the previous text. However, the text will not be published before the end of 2023. This is because the French government has notified the text to the European Commission as it relates to the new packaging and packaging waste regulation: the Packaging and Packaging Waste Regulation (PPWR). The European Commission has decided to block the French project until the end of the year, the time the European institutions consider it necessary to adopt the PPWR.

Agriculture & Bioeconomy

France is further developing its bioenergy sector by increasing biofuel production and biomass utilization for power generation. This development is enhanced by clusters such as the Tenerrdis. This energy cluster coordinates a network of businesses and different stakeholders such as government and academia. The cluster operates in seven technology fields, including biomass and biogas. Among other innovative projects, the National Forest and Wood Program (PNFB), which will be operative until 2026, is an important Initiative aiming at the reduction of GHGs through the utilization of woodlands to absorb carbon. In agriculture, France is promoting sustainable farming practices, the so-called agro-ecological transition. France is also developing cultures like hemp and linen for the production of textiles and other materials. Furthermore, the French Bio-economy Strategy, which was implemented from 2018 to 2020, is now being integrated into the future Common Agricultural Policy (CAP, 2021 – 2027).

Batteries

France has the potential to become Europe’s first battery producer and is investing steadily in the sector. The country recognises the need to produce locally and sustainably and is thus developing a battery ecosystem in Northern France. The government has successfully established a battery gigafactory, which will have an annual capacity of 50-60 GWh, sufficient to equip between 500,000- 750,000 electric vehicles (EVs). In the area, 3 other projects have already been announced. The improvements are consistent with the EU’s Fit for 55 proposals, which were released to encourage Europe to generate more clean technology required to fabricate batteries for EVs. Crucially, there is a great need for action towards the management of end-of-life batteries. The French government will provide € 30 million to 2 projects aimed at the recycling of discarded battery components as part of the 2030 Stimulus Plan. Recovering essential metals (such as lithium, cobalt, and nickel) for the production of new batteries offers undeniable environmental advantages as well as responding to both rise in demand and the ability to attain industry independence.

Major upcoming events

- September 1st, 2023 – Le Forum de Giverny, 5th edition

- September 12-13th, 2023 – Produrable, 16th edition in Paris

- October 10-13th, 2023 – Pollutec Lyon

- July-August 2024 – Olympic Games in Paris

See also related items below.

Relevant networks

Circular Economy think tanks/research institutes

- INEC (Institut National de l’Économie Circulaire)

- Orée (Holland Circular Hotspot partner)

- ADEME (l’Agence de la transition écologique)

Business networks

- Zakelijk netwerk en contacten in Frankrijk

- Business France

- Franse Kamer van Koophandel in Nederland

- French Network of the Circular Economy

Embassies

Useful reports and links

Reports

- Country Profile Circular Economy

- Brochure circular economy recycling techtera.org

- Sector study – The bioeconomy in France

- Waste Management France

- Forse ambities in Frankrijk met biobased economy | Agrospecials |Agroberichten Buitenland

- Circular plastics in France

Links

- www.circularstories.org

- Handelsmissie Olympische Spelen in Frankrijk

- www.eur-lex.europa.eu

- www.ec.europa.eu

- www.agriculture.gouv.fr

- www.nlinfrankrijk.nl

- www.nlinfrankrijk.gigafactory.batterijen.france.nl

Updated: July 2023

Pollutec

Lyon, France | 11th until 13th of October 2023

Event on environmental insights for industries, territories and innovations

Circulair Ondernemen in Europa

RVO, Den Haag | 7th of February 2023

Informatie, inspiratie en ondersteuning

Benelux Circular Economy Business 2022

Luxembourg | 4th until 5th of October 2022

Benelux Circular Economy Business Forum will take place in October 2022.

Circular Plastics in France: what are the opportunities for the Dutch?

Online | 22nd of June 2021

Exclusive opportunity to obtain access to the sector study results!

Opportunity: Present your Dutch Waste Management or Cleantech showcase to the French!

French-Dutch meetup on November 12

Circular Economy & Waste Management: Business Opportunities in France

online | 12th of November 2020

Online meetup for Dutch and French stakeholders

Innovation mission France: Sustainable fashion

Paris/Lille, France | 18th until 20th of November 2020

For Dutch organizations in the fashion sector

France country 2-pager on opportunities for French-Dutch collaboration launched!

Valuable insights on CE in France for Dutch entrepreneurs