Circular economy opportunities in Japan

Japan is well known for its exporting power of products such as cars, electronics, computers and semiconductors. With very low natural resources at its disposal, Japan’s economy is reliant on importing raw materials – making Japan one of the world’s top importers of for instance oil, coal and LNG. This creates a need to keep materials in the loop as long as possible at their highest possible value and offers great circular opportunities like reuse, remanufacturing or recycling.

Thinking about doing business in Japan? Below you will find information on policy landscape, circular economy strategy and selected priority areas!

Economic indicators

- Total Population: 126 million (2019)

- GDP (nominal + ranking): $5,082 trillion USD, World Ranking: 3rd

- GDP Per Capita: $40,246 USD

- Purchasing power : $43,593 (2019)

- Import from the NL (€): 7.7 billion (2019)

- Export to the NL (€): 8.7 billion

- Economic growth: -4.8% (2020)

- Ease of doing business: 29 (2020)

- Corruption perception Index:19/180 (2020)

- Unemployment rate: 2.97% (2020)

- Currency and exchange rate euro: 1 € = 130.18 Yen (2021)

- Time difference with NL: +7/+8 hrs

Circular economy indicators

- Innovation Index rank: 16th / 131 (2020)

- Recycling rate of municipal solid waste: 20% (2019)

- Incineration Rate: 70% (municipal solid waste)

- Effective utilization of plastic waste: 84% (2018)

- Circular material use rate: 15.4% (2016)

- Renewable energy consumption (% of total final energy consumption) (2019): 5.89%

- Material productivity (€/kg): 3.9 (2017)

Policy landscape

Beyond zero carbon

Under the United Nations Climate Change Convention Japan has committed to reduce greenhouse gas (GHG) emissions by 26% from 2013 levels by 2030. In addition, Prime Minister Suga has pledged to reduce greenhouse gas emissions in Japan to net zero by 2050, with a roadmap towards ‘Beyond-Zero’ Carbon targeting 14 priority areas.

Reducing national resource consumption and waste

After the Fukushima nuclear accident in 2011, Japan’s energy fuel mix shifted. Natural gas, oil, and renewable energy shares of total energy consumption have increased to replace some of the nuclear energy share. The country’s Industry Minister Hiroshi Kajiyama stated that it plans to install up to 45 GW of offshore wind power by 2040.

Policies to reduce natural resource consumption and minimize waste have been created. Such as the Act on the Promotion of Effective Utilization of Resources, Green Purchasing Act, Waste Management and Public Cleansing Act, and Food Recycling Law.

Plastic resource circulation strategy

- Cumulative 25% reduction in single-use plastics emissions by 2030

- Reusable/recyclable design by 2025

- 60% rate of recycling/reusing for containers and packaging by 2030

- 100% effective utilization of used plastics by 2035

- Doubled use of recycled plastic by 2030

- Approximate 2 million ton introduction of biomass plastics by 2030

The Japan 2020 circular economy vision

The Japan 2020 Circular Economy Vision was updated from the 1999 vision and focuses on shifting to circular business models, implementing evaluation indicators, and early establishment of resilient resource circulation. For the latter, the focus is in particular on the establishment of domestic recycling systems and development in the key areas: plastics, textile, Carbon Fiber Reenforced Polymers (CFRP), batteries and PV panels.

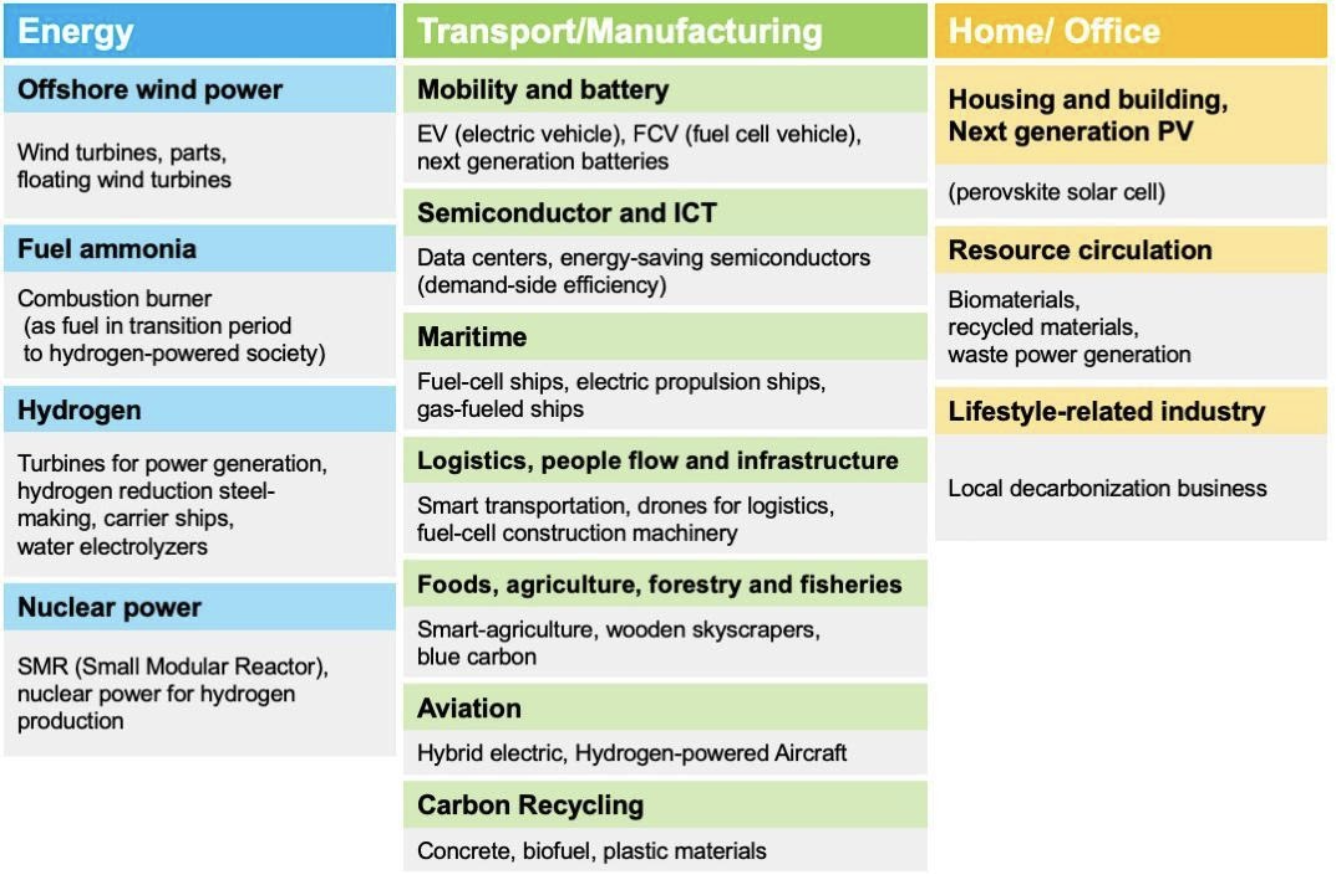

14 Priority areas targeted for reducing gas emissions by 2050

We see two priority areas when it comes to circular economy opportunities and need: The manufacturing- and plastics industry

Dutch Embassy in TokyoCircular manufacturing industry

Japan has a leading industrial and exporting position in a.o. automotive and electronics. Together with its dependency on raw materials, a shift to a circular economy is a necessity considering the possibilities for value retention and take-back. This shift is accelerated by global initiatives such as The Circular Cars Initiative. With Japan’s burgeoning car industry shifting to electric vehicles and an estimated 3 million end-of-life vehicles (ELVs) generated each year, there are increasing opportunities to recover materials for production.

In addition, Japan has the largest aerospace industrial market in Asia

and is a manufacturer and supplier for various aircrafts. There is

potential to advance material recovery and cost efficiency through

collaborative R&D projects to reuse aerospace materials.

Japan is a front-runner in developing hydrogen powered vehicles. Beyond material recovery, manufacturers are looking for innovative manufacturing processes, new materials to lightweight vehicles and new technologies such as hydrogen-powered cars. Japanese companies like Hitachi show Japan is ready to implement refurbishing and remanufacturing strategies. Opportunities for The Netherlands and Japan to collaborate in circular manufacturing lies in refurbishing and remanufacturing of capital equipment goods.

As Japan aims to be the third largest producer in offshore wind power before 2040, Dutch knowledge and experience is a valuable asset in collaboration. Circular offshore wind is a key research area in the Netherlands with broad knowledge ranging from circular tender criteria, modular design of the structural elements and environmental specific foundation design and usage, retaining data (e.g. on modules, components and material levels) for decommissioning, to EoL strategies, Rare earth elements (REE) refinery strategies and circular partner networks.

Plastics

Although Japan is renowned for its approach to waste management and recycling, with one of the world’s highest rates of recycling plastic bottles (85%, compared to Europe’s 41%), the country was also the second-largest generator of plastic packaging waste per capita in the world (2015). Public awareness is increasing, according to a recent survey that showed 70% of consumers in Japan indicate moving away from plastic. Ambitious goals to curb plastic are set out in The Plastic Resource Circulation Strategy.

With limited landfill availability, there is a great opportunity for both mechanical and chemical recycling. In 2020 Suntory launched a joint venture to develop chemical recycling technique, but also waste-to-energy is a solution adopted by companies like Nippon Steel. Mitsubishi Heavy Industries Environmental & Chemical Engineering Co is developing cutting-edge research and new technology in the sector with their waste-to-energy facilities, where even the incineration bottom-ash byproduct is utilised as a raw material for cement.

With 18,000 miles of coastline, Japan is especially dependent on marine resources, and initiatives to tackle marine litter are considered important. Platforms like the Japan Clean Ocean Material Alliance have been established to advance cross-sectoral innovation – from the collection, sorting, recycling, refining, manufacturing and retailing. Opportunities for collaboration are in design (eliminating plastics or design for reuse, refurbishment or recycling), new circular or biobased materials, advanced mechanical recycling and chemical recycling technologies as well in system approaches involving public and private actors. Packaging and WEEE plastics and Ocean Plastics in general seem topics with momentum for Japan.

Relevant networks

Circular economy networks in Japan

Business networks

- Japan Clean Ocean Material Alliance (CLOMA)

- Japan Climate Initiative

- Japan External Trade Organization (JETRO)

- Keidanren, Japan Business Federation

- The Netherlands Chamber of Commerce in Japan

- Netherlands Enterprise Agency Japan

- NLinBusiness page of Cities of Opportunities Tokio

- Netherlands Enterprise Agency (RVO)

Embassies

Lessons for Japan's Circular Economic Future

Japan | online | 3rd of April 2023

Learning from experiences of Netherlands, Australia and Kitakyushu

Tokyo Olympics podcast: circular economy and international business

Podcast: HCH's Freek van Eijk and former Dutch Olympic Judoka Edith Bosch

Japan and the Netherlands collaborate to accelerate the Circular Economy

A series on opportunities and challenges for a shared circular economy

The Circular Economy topic gains traction in Asia

NL-Japanese Circular Series at Team NL Tokyo Expo 2020

Team NL Tokyo Expo: Roundtable Circular Economy

Online | 6th of July 2021

High level roundtable with decision- and change makers from NL and Japan

Team NL Tokyo Expo: Webinar Circularity in Manufacturing

Online | 1st of July 2021

Showcasing Dutch and Japanese circular showcases

Team NL Tokyo Expo: Webinar Circularity in Plastics

Online | 24th of June 2021

Showcasing Dutch and Japanese circular showcases