Circular economy opportunities in the United Kingdom

The United Kingdom is committed to moving towards a more circular economy by minimizing waste, promoting resource efficiency and long-lasting resources. In this sense, the Circular Economy Package (CEP) introduced a legislative framework, identifying steps for an ambitious long path for waste management and recycling. It acknowledges that a circular economy can strengthen British-Dutch collaboration in the field.

Seeking business opportunities in the UK? Below you will find information on the policy landscape, selected priority areas, and relevant business networks.

Facts & Figures

Economic indicators

- Population (2021): 67,4 million

- Nominal GDP + Ranking (2020): $2,71 trillion, 5th

- Purchasing power (2019): $42.416

- Export from the NL (2019): €39,8 million

- Economic growth (2020): 9.85%

- Ease of doing business rank (2020): 8/190

- Corruption perception index (2019): 77/100 score, rank 11/180

- Unemployment rate (2020): 4.5%

- Currency: Pound Sterling

- Time difference NL: -1 hrs

Circular economy indicators

- Global innovation index (2020): 4th

- Municipal waste recycling rate (2018): 45%

- Renewable energy generation (2021): 42.8%

- £22,5 million invested in 5 CE centres focusing on waste, textiles and construction sectors

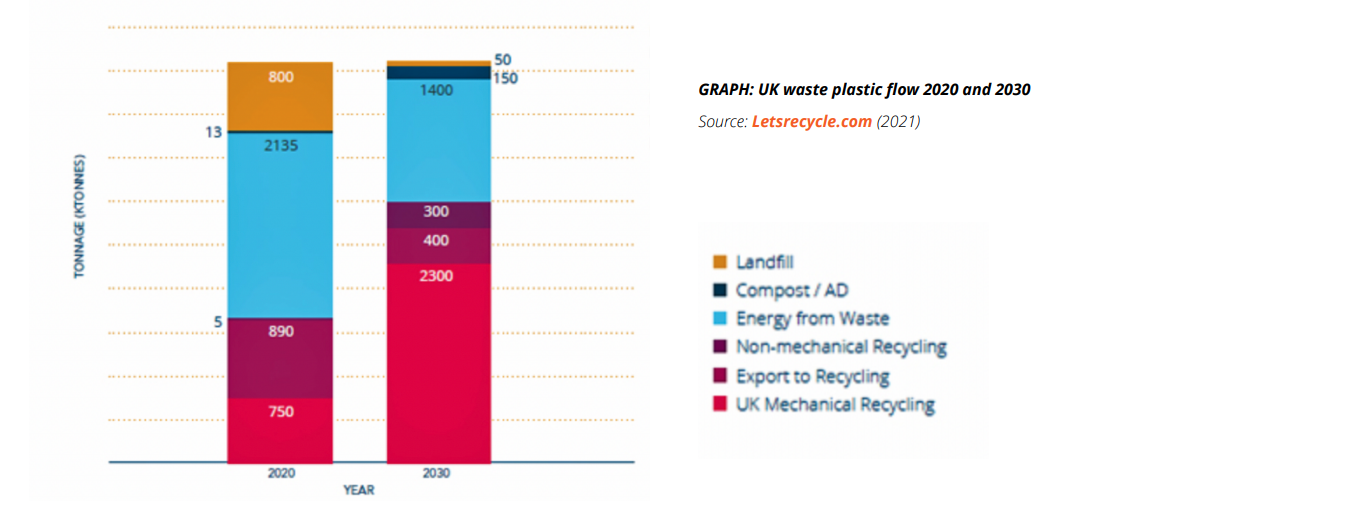

Source: letsrecycle.com (2021)

Policy landscape

The UK is a former member of the European Union, who left the EU in 2020. This ‘Brexit’ had great consequences for international collaboration with the UK, but circular economy offers ground for new cooperation.

National circular economy related ambitions

Although the UK has withdrawn from the European Green Deal when leaving the EU, they kept up their ambitions by introducing the Ten Point Plan to increase national resource efficiency and minimise impacts on climate change. Also, they implemented their legally binding target for net-zero emissions by 2050, early on.

Other relevant CE policies include:

- Circular Economy Package (CEP): the overarching legislative framework focusing on resource efficiency linked to waste management.

- The Environment Act: the updated framework for environmental protection with a wide range of legally binding measures, e.g. on recycling rates, suspension of waste exporting, circular design requirements, and strong extended producer responsibility schemes.

- Build Back Better: Our plan for growth: a governmental strategy for investments in infrastructure, skills and innovation focusing on sustainable growth and CE.

Regional level

Each country has additionally determined its own pathway towards circularity. England designed a Green Future Plan and the Resource and Waste Strategy (RWS), providing business opportunities in the retrofitting and construction sectors. Wales offers business potential in plastics and new materials. Their “Beyond recycling”: CE strategy (2021) guides their efforts towards their 2050 zero-waste and net-zero targets. Scotland determined their CE strategy ‘Making things last’ focusing on the manufacturing industry and offering opportunities for oil & gas divestment. Under the umbrella of the CEP, Northern Ireland is prioritising the reduction of household waste by increasing municipal recycling capacity within the upcoming ‘Environment Strategy for Northern Ireland’.

Extended Producer Responsibility (EPR)

Current producer responsibility regulations in the UK cover electrical and electronic equipment (EEE), batteries, and end-of-life vehicles (ELVs), while textiles, furniture, and mattresses are planned to be included starting from 2024. In addition, coming into effect 1st of January 2023, UK packaging businesses with a turnover of £1m and a minimum packaging volume of 25 tons annually will need to follow a list of mandatory activities regarding their business processes. These include the collection and submission of data on the packaging handled and supplies, payment of a waste management fee, and the purchase of packaging waste recycling notes or packaging waste export recycling notes. More details can be found on the UK gov page.

Plastics

Annually around 5 million tons of plastic are consumed in the UK, of which almost 50% accounts for packaging waste. The UK targets the elimination of all avoidable plastic waste by 2042, amongst others via a plastic packaging tax effective since 2022. Crucial elements for a circular plastics sector are the UK Plastic Pact and the Plastic Industry Recycling Action Plan working on a value chain approach to increase recycling volumes by means of purposeful design and improved collection, and both sorting systems. Recycling services will need to be expanded to meet such targets, which offers attractive business opportunities for Dutch chemical and mechanical recycling companies. As the development of end markets to line up the plastic chain remains critical, Dutch business models focused on upcycling plastic waste can be of inspiration for UK counterparts.

Fashion & Textiles

Textiles and its environmental pollution exacerbated by fastfashion culture is a hot topic in the UK and focus topic of the Waste Prevention Programme for England. To enforce collection and enhance sustainable business models, the Resources and waste strategy for England offers textiles chain stakeholders consultation on better design and labelling of clothing for recycling purposes and extended producer responsibility schemes. With Textiles 2030 the industry takes initiative on reducing its water use and carbon footprint. As textiles is a focus sector of the Netherlands towards full circularity by 2050, the Dutch can share their insights into circular textiles opportunities and research, and inspire with business models. The UK is an attractive business case for Dutch high-quality technology that allows to recycle textiles into feedstock garment quality and innovative dying techniques for circular textiles made in the UK.

Construction and Built Environment

Although the UK has thus far been risk-averse and slow to innovate in this sector, recent resource scarcity and rising prices are fostering the development of CE. The built environment accounts for 40% of the UK´s carbon footprint. The Green Construction Board thus aims at 50% emissions reduction by 2050 and improved resource efficiency. The UK thus seeks for expert inputs to achieve these goals and announced an investment of £650 billions within the next decade in smart and sustainable buildings and infrastructure. This provides opportunities for Dutch businesses working at city and regional levels to offer smart solutions for innovative building technologies and materials. Dutch entrepreneurs can contribute ideas on how to integrate nature into construction and share experiences on value chain collaborations for resource flows optimisation and on the role of the public sector in supporting the transition into a circular built environment.

Offshore Windfarms

The offshore windfarm sector is fast growing in the UK. Between 2019 to 2020, offshore windfarms increased productivity by 26% and is aimed to quadruple its output by 2030. Today, the UK operates the world’s largest windfarm as well as the first floating offshore windfarms. Most windfarms are located along the coasts of England and Wales. Considered as the 1st point in the Ten Point Plan, the sector receives financial attention by the government. However, crucial areas of development are the re-build of the energy infrastructure to utilize offshore wind energy including energy storage. With the aim of providing green energy, also the wind plant´s environmental footprints must be considered. Providing circular design and technology, to build with nature, and to assure all components to be re-usable and recyclable are business opportunities waiting in the UK.

Waste Management

This sector totals £9 billion in annual turnover in the UK. Current recycling rates are between 44% in England and 56% in Wales, with the aim to reach 65% municipal recycling and reduce landfill by 10%. A combination of Anaerobic digestion (AD), incineration, EfW, Material Recovery (MRF), chemical and mechanical sorting, and landfill is applied. The government actively supports low-carbon technologies including infrastructure to use waste as an energy source. The leading waste management firms in the UK are Biffa, Veolia, FCC Environment, Suez, Viridor, and Renewi.

Upcoming events

- Highways UK: transport and logistics, 2 – 3 November 2022 (Birmingham, UK)

- COP27 in Egypt – 6 – 18 November 2023

- Futurebuild – 7 – 9 March 2023

- Footprint+ – 6-8 June 2023

- Interplas – 26 – 28 September 2023

Relevant networks

CE think tanks/research institutes

- UK Circular Plastic Network

- Circular Economy Wales

- Ellen Macarthur Foundation

- Zero Waste Scotland

- Circular Edinburgh

- Circular Glasgow

- ReLondon

- Wrap

- Green Alliance

Business networks

- Aldersgate Group

- ASBP

- KTN

- UKMSN

- Doing Business in the United Kingdom

- UK Green Building Council

- Construction Leadership Council

- Circular Construction in Regenerative Cities

- Make UK – Manufacturing Association

- RSA – Royal Society for Arts, Manufacturers and Commerce

- The Chartered Institute of Waste Management

- UK Research and Innovation (Innovate UK)

- Innovate UK Edge

- Cambridge Cleantech

Embassies

Useful reports

- Factsheet: Circular Economy in the United Kingdom

- Closing the circle. Circular economy: Opportunity for the welsh built environment

- Plastic Waste

- UK Government: A Green Future: Our 25 Year Plan to Improve the Environment

- Circular Cities

- Municipal recycling potential in Northern Ireland

- Brexit and Circular Economy Law: Challenges and Opportunities

- 10 Point Plan for a Green Industrial Revolution

- The Construction Index: Top 100 UK construction firms

- London Energy Transformation Initiative

- UK Heat & Building Strategy (2021)

- Circular Online

- National Infrastructure Strategy

NL-UK Collaboration on Circular Construction

Bringing together Dutch and British organisations to discuss collaboration

NL visit to the UK: Circular construction

London, UK | 6th until 7th of March 2023

Explore opportunities for collaboration and visit Futurebuild

Circulair Ondernemen in Europa

RVO, Den Haag | 7th of February 2023

Informatie, inspiratie en ondersteuning

Festival of Circular Economy

Virtual | 28th of November until 1st of December 2022

With over 60 speakers, the event will explore barriers to circularity.

NL International Business Day

KAS, De Bleek 13, 3447 GV Woerden | 9th of September 2022

Discover international business opportunities during the NL Business Day

Circular Economy Opportunity Seminar in the United Kingdom

The Hague, NL | 23rd of June 2022

Opportunities for Dutch companies in the UK

Dutch embassies share experiences on building international CE framework

Representatives presented their experiences in circular economy

Dutch-English conversations on circular solutions in plastics, textiles and built environment!

Strengthening collaboration between The UK and The Netherlands

Strengthening Anglo-Dutch circular collaboration

online | 29th of April 2021

The future is circular

Conference of the Parties (COP 26)

Glasgow, UK | 9th until 19th of November 2020

UK to host 2020 UN climate summit