Circular economy opportunities in Belgium

Belgium shows interesting characteristics for doing business with in the field of circular economy. With its GDP ranking 23rd in the world, a geographically favorable location and having ambitious circular economy and waste management goals, Belgium-Dutch collaboration is not unlikely.

Thinking about doing business in Belgium? Below you will find information on policy landscape, circular economy strategy and selected priority areas!

Facts & Figures

Economic indicators

• Population (2022): 11,65mln

• Nominal GDP (2021): €502,2 billion: 23/53

• Purchasing power (2021): €49,793

• Import from the NL (2021) €70,2 billion

• Economic growth (2022): 2,4%

• Ease of doing business rank (2019): 46/190

• Corruption index (2021): 23/198

• Unemployment rate (2021): 6,4%

• Currency: €

• Time difference NL: +0.00 hrs

Circular economy indicators

• Global innovation index (2021): 22/132

• Municipal waste recycling rate (2020): 52,0%

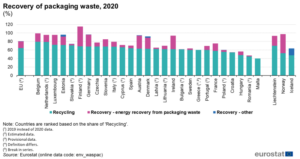

• Packaging waste recycling rate (2020): 79.2%, #1 in Europe

• Circular material use rate (2019): 23,5%

Policy landscape

EU level

In 2015 European Commission adopted the Circular Economy Action Plan, which included comprehensive measures addressing waste management. The EU laws set minimum recycling, landfilling, material recovery and renewable energy consumption targets. Among other initiatives introduced in the Plan is the plastics strategy which aims to ban and reduce consumption of certain types of single-use plastic. New Circular Economy Action Plan adopted in March 2020 will aim among others to facilitate circularity in textile industry and production of electronic equipment. Belgium transposes timely EU legislation on CE and performs above EU average on attaining some of their targets. Particularly, the country ranks 1st in EU in packaging waste recycling.

Currently main targets include:

- min. 65% of municipal waste to be recycled by 2035

- min. 70% of all packaging waste to be recycled by 2030

- max. 10% of municipal waste to be landfilled by 2035

- ban on single-use plastic products taking effect step by step as from July 2021

- min. 32 % of the Union’s gross final consumption of energy to originate from renewable sources by 2030

National level

Belgium first adopted national CE strategy in 2014. In December 2021 the Federal action plan circular economy 2021-2024 was published. The measures in this action plan will target sectors and product groups with the largest environmental footprint and circularity potential, including electrical and electronic equipment, chemicals, batteries and vehicles, packaging, plastics, textiles and construction.Within the framework of the National Recovery and Resilience Plan (NRRP), the federal government will launch the “Belgium Builds Back Circular” investment project, which should accelerate the transition to a circular economy in Belgium.

Regional level

Flemish region

The Government of Flanders adopted strategy Vision 2050 which set CE as one of the seven transition priorities. Circular Flanders, was launched in 2017 by OVAM, to ensure Flanders transition to the circular economy by 2050. The current Flemish Government confirmed this objective and voiced their ambition to transform Flanders into a circular trendsetter in Europe by 2030. To do that, they aim to separate the material footprint created by Flemish consumption from economic growth and reduce that footprint by 30%. With the Circular Economy Monitor 100 indicators are measured and analysed to keep track for the progress.

Through public-private partnerships they are working on 7 strategic levers and six themed strategic agenda’s: circular construction, chemicals and plastics, water cycles, biobased economy, food chain and manufacturing (textiles, furniture, electronics, batteries, etc.)

Walloon Region

CE is one of the major political priorities as it is reflected in the political in Regional Policy Declaration for Wallonia (2019-2024). In February 2021, the Walloon Government adopted Circular Wallonia, the first strategy for deploying the circular economy in the Walloon Region. The strategy includes 10 ambitions translated into 60 specific measures which aim to facilitate the circular transition of Walloon economic players.

Circular Wallonia focuses its action on 6 priority value chains: construction and buildings, water, metallurgy (including rare metals and batteries), textiles, food and food systems, plastics and on a transversal value chain: the biobased economy.

Brussels-Capital Region

CE strategy, adopted in 2016, sets a 10-year framework to move Brussels’ economy towards a circular model. The strategy is focused on 3 objectives: transform environmental goals into economic opportunities, anchor the Brussels economy, where possible, to local produce and to minimise transportation whilst optimising the use of available territory in order to create additional value for the people of Brussels and to contribute to the creation of employment.

"Belgium is our second largest trading partner worldwide. Belgium and the Netherlands have been at the forefront of economic innovations in Europe for 400 years, we also want to lead the way together in the field of the circular economy"

Minister Liesje Schreinemacher - Foreign Trade and Development Cooperation

Circular Buildings and Utilities

The importance of circular construction in Belgium seems self-evident because many factors steer in that direction: rising energy and raw material prices, policy, laws and regulations, more sustainable consumers, global crises, etc.

Belgium is still in early stages of circular building in comparison to the Netherlands: the focus is mainly on pilot projects, cases, and raising awareness. Brussels and the Flemish cities of Leuven, Mechelen, Antwerp and Ghent have developed policies on the transition to a sustainable and circular construction economy. Overarching initiatives, such as Circular Flanders, and the Working Agenda on Circular Building contribute to this development.

Sustainable building, on the other hand, is already well known in Belgium. Specifically, Wallonia has a long tradition using local natural building materials and methods, which is now reinterpreted and innovated for a breakthrough in bio-ecological building. Following the high share of self-build in total housing production in Belgium (45% vs 11% in NL), initiatives have been developed to inform and support this specific group in making their homes more sustainable.

Within the framework of the National Recovery and Resilience Plan (NRRP), more than 1 billion euros is made available for the renovation of buildings. This includes in particular public buildings, social infrastructure and residential housing, and more generally, the buildings worst performing in energy efficiency. In addition, the NRRP makes 25 million euros available for circular building and manufacturing in Flanders to stimulate research and innovation.

Opportunities for Dutch-Belgian cooperation are highlighted in the 2022 market study Kansenrapport Duurzame & Circulaire Bouw in België (Dutch). Most opportunities were found in four Flemish cities plus Brussels. In addition opportunities for overarching themes were found for transparency and measurement of circularity and requirements for circular procurement and certification. More concrete topics are innovation with secondary material (concrete), flexible and modular design, digital solutions (material passports), zero-energy- and healthy buildings and bio-based materials.

Circular infrastructure

In Flanders, especially the Antwerp area, large infrastructural projects have started which typically have a significant environmental footprint. Large parts of existing infrastructure require renovation as well and there is a growing need for additional infrastructure that is safe, durable, and economically viable. Circular business models that increase modularity and new lifetime-oriented consortium between infrastructure companies and their customers might offer inspiration.

Belgium is home to numerous producers of construction materials and technologies that respond to the changing needs with regard to comfort, safety, and environment. The Netherlands is, in its turn, innovative in creating circular business models that include the entire value chain, with a focus on long-term design thinking and technology.

Circular Plastics

Belgium has a large polymer industry and there is a great interest in making it more sustainable. The market exploration Circulair ondernemen in België Marktkansen in de gebouwde omgeving & plastics (Dutch) and a trade mission at the end of 2021 have shown that there are circular opportunities for plastics & chemical recycling in Belgium. Several publications have been shared from Europe about the plastic problem and an active policy is being pursued to reduce the plastic waste mountain. In Belgium, too, more and more policy is aimed at making plastics more sustainable.

The level of knowledge in the field of circular plastics in Belgium – and in particular in Flanders – is largely comparable to that in the Netherlands. Circular Flanders launched a Working Agenda on chemistry/plastics with actions to pave the way to circular chemical chemistry and plastics. The overlap in terms of policy and programmes, such as the promotion of ecodesign, circular business models and higher use of recycled plastics in products, offers opportunities for more in-depth cooperation.

Belgium is a leader in Europe in the field of packaging recycling. The plans to encourage more (local) recycling of more (types of) plastic residual flow is supported by an investment injection of 700 million euros in new (PMD) sorting centers and recycling machines in Flanders and Wallonia. This offers opportunities for companies that offer effective sorting and recycling technologies.

Chemical Recycling

Major players in the (petro)chemical sector with interest in chemical recycling can be found close to each other in Belgium around Antwerp/Ghent.

Flanders, together with North Rhine Westphalia (DE) and the Netherlands is home to one of the world’s most powerful chemical industry cluster. The regions have agreed on triletaral cooperation which represents a game changer in sustainability and circularity. It strives to become the world’s engine for the transition towards a sustainable and competitive chemical industry cluster. Despite the fact that much cross-border Dutch-Belgian cooperation is already taking place (e.g., within the framework of European funded projects), in order to achieve more ambitious goals, cooperation with the Netherlands is explicitly mentioned as an opportunity.

The ambitious plans especially offer opportunities for Dutch companies that develop innovative technologies for chemical recycling.

Relevant networks

CE platforms

- Circular Flanders

- Circular Wallonia

- Be Circular (Circular Economy Brussels)

Business networks

- Nederlandse Kamer van Koophandel voor België en Luxemburg

- Verbond van Belgische Ondernemingen

- Flanders in the Netherlands

- Invest in Wallonia

- SRIW (Regional Development Company of Wallonia)

Embassies

Useful reports

- Kansenrapport Duurzame & Circulair Bouw in België (Dutch)

- Circulair ondernemen in België Marktkansen in de gebouwde omgeving & plastics (Dutch)

- Circular Economy for Plastics – Belgium 2020(factsheet)

- The Circular Economy for Plastics – A European overview

- Circulaire tewerkstelling in België – Een nulmeting van de werkgelegenheid in de circulaire economie in België

- Circular Flanders Retrospective Report 2017-2019

- The Belgian plastics industry and the circular economy

- Belgium’s recovery and resilience plan

- Federaal actieplan circulaire economie 2021-2024 (Dutch)

- Stratégie Circular Wallonia (French)

World Circular Economy Forum heads to Brussels in Spring 2024

WCEF2024 will take place in Brussels, Belgium.

Climate technology economic mission to Belgium with Minister Schreinemacher

Brussel/Antwerpen | 20th until 22nd of June 2023

Mission on climate-neutral construction parallel to a state visit

Financing local circular economy initiatives

Brussels, Belgium | 10th of May 2023

Sharing of best practices and guidance about the financing circular economy

Circulair Ondernemen in Europa

RVO, Den Haag | 7th of February 2023

Informatie, inspiratie en ondersteuning

Setting foot in Belgium: Dialogue sessions on Dutch-Belgian market potential for circular plastics and construction

Recap of the two dialogue meetings held in The Hague on November 8.

Chemical Recycling is gaining momentum!

Join the Chemical Recycling Summit 2022

'Sustainable packaging beyond borders' seminar

Antwerp and online | 17th of November 2022

The seminar will discuss challenges for fibre-based packaging.

Belgian trade and economic mission to the NL

Eindhoven, the Netherlands | 3rd until 5th of October 2022

Belgian trade and economic mission to Eindhoven, Netherlands.

Benelux Circular Economy Business 2022

Luxembourg | 4th until 5th of October 2022

Benelux Circular Economy Business Forum will take place in October 2022.

Circular entrepreneurship in Belgium

RVO Den Haag | 8th of November 2022

Opportunities for Dutch circular companies in Belgium

Will you host the 2024 Circular Economy Hotspot Event?

Host the 2024 Circular Economy Hotspot Event

New publication: 'Circular Buildings: constructing a sustainable future'

Inspiring circular collaboration between the building environment

NL Trade Mission to Belgium – Circular Infrastructure and Construction

The Netherlands & Belgium seeks cooperation in the construction field

The Taxshift: An EU Fiscal Strategy to Support the Inclusive Circular Economy

Brussels, Belgium | 2nd of June 2022

The official launch of the groundbreaking study

ECESP Networking Village: Inspiring Young Generations to be the Center of CE Transition

Sessions with professionals towards sustainable consumption

Webinar on Sustainable and Circular Construction in Belgium

Online | 21st of April 2022

Interactive session on market opportunities and relevant tenders in Belgium

NL Trade Mission to Belgium - Circular Infrastructure and Construction

Brussels, Antwerp, Ghent and/or Leuven | 19th until 20th of May 2022

Explore circular infrastructure businesses with Minister Schreinemacher

Dutch embassies share experiences on building international CE framework

Representatives presented their experiences in circular economy

Trade mission circular economy in Belgium

Brussels and surroundings | 17th until 19th of November 2021

Circular Economy: Trade mission Belgium

Opportunity Seminar Circular Economy within the Built Environment and Plastics in Belgium

online | 12th of October 2021

Opportunities for Dutch companies in Belgium

Durable, repairable and mainstream - make textiles circular

online | 20th of April 2021

How ecodesign can make textiles circular

Benelux collaboration for recovery plans in circular construction

Webinar report 'Benelux Builds Circular'