Circular economy opportunities in Malaysia

With fast-developing cities and a population of more than 32 million, Malaysia faces both challenges and opportunities in its transition to a circular economy. The lack of implemented extended producer responsibility (EPR) and the public sector’s limited capabilities in waste management, makes the country miss out on potential value from recycling. Yet, Malaysia has a strong manufacturing base and keeps growing rapidly. Huge company-driven actions on plastic packaging stimulate the country to make room for new market opportunities from design to production, usage to the collection, sorting, recycling, and applying recyclate in new products. With the government’s ambition to reduce greenhouse emissions by 45% in 2030, opportunities for collaboration with The Netherlands as a niche leader in circular manufacturing, seem likely.

Thinking about doing business in Malaysia? Below you will find a summary of the information on policy landscape, circular economy strategy, and selected priority areas. For more information, please click here for the 4-pager PDF file.

Facts & Figures

Economic indicators

- Size: Malaysia is 8 times larger than the size of The Netherlands

- Total Landmass: 329.847 square kilometers (Peninsular Malaysia and East Malaysia (Sabah and Sarawak)

- Population (2020): 32,79 mln

- Nominal GDP (2020): €342.442 bln, world rank: 36th

- Import from the NL (2020): €884,6 million

- Economic growth (2021 ): 3-4%

- Ease of doing business rank (2020): 24

- Corruption index (2021): 65/198

- Unemployment rate (2020): 4,55%

- Currency: Malaysian Ringgit

- Time difference NL: + 6/7hrs

Circular economy indicators

- Global innovation index (2020): 33/133

- Recycling rate of municipal solid waste (2020): 30,67%

- Renewable energy consumption (2018): 5,3%

Solid waste composition in Malaysia (2019)

Policy Landscape

Malaysia is a country with a federal constitutional monarchy, which has 13 states and 3 federal territories. Malaysia has a King as the head of the country, while the executive power is held by the Prime Minister of the cabinet. Manufacturing is now the Malaysian core sector with several primary industries, such as electrical & electronics (E&E), petroleum products and petrochemicals, semiconductors and machinery, and equipment. Other sectors supporting the country’s economy are palm oil and forestry.

Malaysia has set ambitious goals towards sustainability and circular transition:

- The target of recycling rate in 2025: 40%

- A reduction of gas emissions in 2030: 45%

Malaysia has also developed some actions toward circularity:

- Twelfth Malaysian Plan 2021-2025, a roadmap towards circular economy transition

- Malaysia Plastics Sustainability Roadmap 2021-2030, a strategy on escalating EPR regulation in the plastics sector

- Green Technology Master Plan, a set of collaborative actions to develop greener technology in Malaysia

- National Solid Waste Management Policy, an extensive regulation that rules the classification of solid waste, the responsible stakeholders, and a strategy to recycle waste from households and industries

“We see four priority areas when it comes to circular economy opportunities and needs: Manufacturing, plastics, biomass, and waste management"

Dutch Embassy in MalaysiaManufacturing industry

Malaysia’s Investment Performance Report on 2019 shows that remanufacturing the top Malaysian industries (electrical and electronics, vehicle components, chemical, rubber, plastics) can generate three times the current value to the Malaysian economy. Establishing refurbishment and remanufacturing for those industries can be key strategies for Malaysia and for Dutch business partners.

In addition, there is a new market opportunity on electric vehicles (EVs) as the Malaysian government announced on their 2022 National Budget to eliminate all taxes on EVs in Malaysia. The support from the Malaysian government is expected to increase the demand for sustainable batteries.

Adopting a smart industry strategy and enhancing digitization can be beneficial to build a data matching platform for data collection and analysis. Furthermore, combining servitization and smart technologies will make resource efficiency more valuable for industries. Implementing digitization on vehicle components, ICT, medical devices, and aerospace industries can help them to create a more effective production system.

Lastly, the district cooling energy system can be seen as a new strategy as well. Currently, the Malaysian government seeks companies that can provide energy from other renewable energy sources, like biomass and hydropower, or waste-to-energy projects linked to cooling installations.

Plastics

In 2019, WWF Malaysia reported that the country, compared to China, Indonesia, the Philippines, Thailand, and Vietnam, was the biggest consumer of used plastics per year, with 16,78 kg per person. However, only 24% of it was recycled. The loss of material value in the plastics sector creates economic consequences as the country would potentially lose up to €887 million per year in the plastics recycling market.

Meanwhile, plastics recycling in Malaysia is mostly done by voluntary initiatives, driven by FMCG multinationals in Malaysia. The multinationals started the projects to collect and recycle their plastic packaging waste. Malaysia has room to scale the initiations further and professionalize closed plastic value chains. Dutch product designers in packaging can see this as an opportunity to offer their knowledge in redesigning product packaging.

Technologies such as repurposing non-bottle-PET waste products, training on waste segregation, and certifications on sustainable initiatives are other solutions for the Malaysian plastic waste problem which can be explored.

Biomass

As a leading country in agriculture, Malaysia produces more than 103 million tons of biomass, including agricultural waste, forest residues, and municipal waste. More than 90% of the biomass is derived from palm oil mill residues. Organic residues of the palm oil industry are partly converted into biogas in digesters.

Local companies, mostly based in Sabah and Sarawak face challenges to develop the biomass industry. New technologies and expertise are difficult to find. In addition, Malaysia has the need to sustain its electricity generation mix and pursue new methods to generate from domestic sources. This offers opportunities for collaborative research in the agriculture sector. Combining the expertise fields of biomass, water waste- and energy management offers opportunities for Dutch experts in the palm oil industry.

Further digitalization of the biomass industry at large to identify available and utilized residues can be one of the newer opportunities. Another potential market rises in biogas trapping and methane capturing activities from POME (palm oil mill effluent) treatment. Engaging Dutch entrepreneurs and experts in this field will create business opportunities for renewable biomass energy projects and services.

Waste Management

The Department of Statistics Malaysia stated that the country generated about 38.000 metric tonnes of waste daily in 2019. Overcoming the problem, the government set big ambitions to raise the recycling rate. Lack of information and skills on the waste flows, segregation and recycling become challenges. Furthermore, civil society organizations and academics have limited data on volume waste generation and waste treatment.

Dutch businesses can provide technology and equipment supplies for waste sorting and segregation. Providing digital technology to identify the types of plastics in MSW is expected to be the winner technology. In addition, organic and food waste valorization from MSW is still underutilized. Experts are needed to develop the strategy for that sector.

Lastly, business opportunities evolve in Selangor Maritime Projects. The state wants to rehabilitate the ecosystem along the Klang River and needs assistance. Several actions are possible: developing methods on river waste management, sharing knowledge on renewable energy solutions, building circular economy strategies, and knowledge transfer on biodiversity preservation.

Relevant networks

Circular Economy think tanks/research institutes

Business networks

- Malaysian Dutch Business Council (MDBC)

- Malaysia Recycling Alliance Berhad (MAREA)

- MBI Selangor

- Federation of Malaysian Manufacturers

Embassies

Useful reports & links

- Sustainable waste management in Malaysia

- The Potential of New Conversion Technologies for Adding Value to Malaysian Oil Palm Residues and Increasing Sustainability

- EPR Scheme Assessment for Packaging Waste in Malaysia

- Manufacturing Sector in Malaysia

- Market Study for plastics sector in Malaysia

- Malaysia Plastics Sustainability Roadmap 2021-2030

- Malaysia’s Circular Cities Blueprint

Interview with Freek van Eijk for CreativeNL

Freek van Eijk Shares Perspectives Gained at the ReThink Event in Hong Kong

Dutch Mission in Hong Kong and Shenzhen

Rethink Conference and activities attended in Hong Kong and Shenzhen

Aliter Networks - Make a difference with IT

Aimes at extending the life of IT assets

The Netherlands and Hong Kong join forces in circular design at BoDW 2023

New collaboration between Dutch -Hong Kong partners

Webinar: Circular bio-economy in Thailand

online | 13th of December 2022

Explore opportunities for Dutch-Thai collaboration

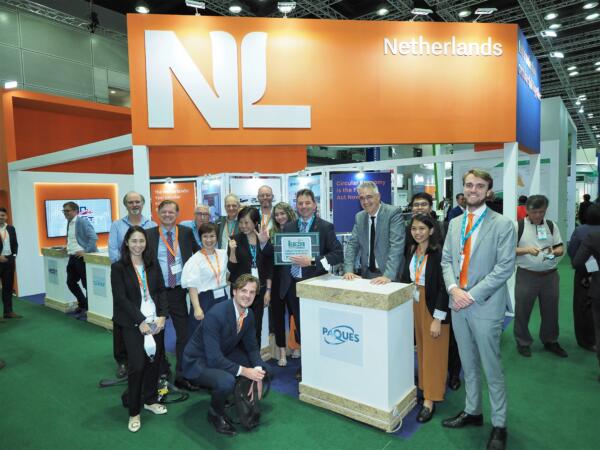

The NL mission to Malaysia: Solving Global Challenges Together

10 Dutch frontrunners participated in the Dutch trade mission to IGEM.

Circularity 2022: Driving Circular Innovation in the Asia Pacific

Hilton Sydney | 24th until 25th of November 2022

Join the event to learn about CE development in Australia and APAC.

New publication: ‘Waste Management as a catalyst to a Circular Economy'

The publication was launched during the NL mission to Malaysia.

Orange Green Days: Circular design workshop organized at the NL Embassy in Thailand

Circular workshop organized in the NL Embassy in Thailand

Will you host the 2024 Circular Economy Hotspot Event?

Host the 2024 Circular Economy Hotspot Event

NL International Business Day

KAS, De Bleek 13, 3447 GV Woerden | 9th of September 2022

Discover international business opportunities during the NL Business Day

Trade mission ASEAN-5 waste management & circular economy to IGEM Malaysia

Kuala Lumpur, MY | 10th until 14th of October 2022

Join the ASEAN-5 Waste Management & Circular Economy trade mission

Virtual trade mission China - Circular smart solutions construction and infrastructure

50th-anniversary diplomatic relations between the Netherlands and China

Seminar on waste management Malaysia & invitation ASEAN trade mission

RVO offices, The Hague NL/ online | 23rd of June 2022

Presentation of business opportunities on Waste Management in ASEAN

Virtual trade mission China on circular smart solutions construction and infrastructure

Online | 9th until 12th of May 2022

Explore circular business opportunities with Minister Schreinemacher

Hydropower and Dams Conference, ASIA 2023

Kuala Lumpur, Malaysia | 14th until 16th of March 2023

Conference and study tour for global water and energy community.

International Conference on Urban Economy and Sustainable Development

Online & Kuala Lumpur, Malaysia | 6th until 7th of December 2022

A platform for multistakeholder to discuss sustainable development.

The 3rd World Conference on Waste Management 2022

online | 10th until 11th of March 2022

Theme: Challenge & Practices on Waste Management and COVID-19 Post-Pandemic

Singapore: The Netherlands Virtual CE Study Visit

online | 13th until 14th of December 2021

Virtual tour visit to the Netherlands within the circular economy sector

The Future of the Circular Economy in the Philippines

online | 15th of November 2021

Circular Economy in the Philippines and the Netherlands

Open Call for CE Hotspot 2023

Call for hosting the Circular Economy Hotspot 2023 opens

Tokyo Olympics podcast: circular economy and international business

Podcast: HCH's Freek van Eijk and former Dutch Olympic Judoka Edith Bosch

Plastic Waste Management in Vietnam

online | 31st of August 2021

Explore opportunities for Dutch-Vietnamese collaboration

The 4th Indonesia Circular Economy Forum 2021

online | 21st until 23rd of July 2021

Towards Smart and Sustainable Cities through Circular Economy in Indonesia

Webinar "Out of the Box." A Dutch Approach to Tackling Food & Organic Waste

online | 17th of June 2021

Innovative ways to improve food and organic waste management

Circular Plastic Use: Innovate & Change to close the loop

online | 1st until 30th of June 2021

Best collaborative experience for plastic value change

Doing Business in the Philippines Roadshow

online | 1st of June 2021

Opportunities for Dutch companies to do businesses in the Philippines

Kick-Off: North Sumatra Virtual Focus Sessions

online | 28th of April 2021

AgriFood, Water, Renewable Energy, Waste & CE

ReMeet 'Virtual trade mission to Southeast Asia 2020'

Online | 9th of March 2021

An update of the latest developments in the region

The benefits of a circular economy for achieving climate objectives and recovering better

online | 25th of February 2021

A pre-event of the WCEF+Climate

Bluecon - Decentralized Small Scale Wastewater Solutions

Solutions which keep water circulating.

Join the Pipe - City Water

Filtered tap-water in a reusable bottle.

Excess Materials Exchange - The Digital Platform

Where to exchange any type of excess material across industries

Liveability Challenge 2021 Application

online | 15th of January until 15th of April 2021

Criteria for solutions to be submitted.

Circular Polyolefins Outlook

online | 27th of January 2021

Development and trends in regulation, practices and product design.

Sustainable Materials Management Solutions to Marine Debris

online | 10th of November 2020

Circular design for clean oceans

Virtual Mission Track Waste Management & Circular Design South-East Asia

CE opportunities in Indonesia, Thailand, Vietnam, Malaysia and Singapore.

Virtual Mission Waste Management & Circular Design South-East Asia

online | 12th of October until 11th of December 2020

Virtual CE mission with Minister Sigrid Kaag