Circular Economy: The UK Market

July 15, 2022

Specifically aimed at Dutch SMEs, the Factsheet: Circular Economy in the United Kingdom – Key opportunities for Dutch businesses gives insights into understanding the current circular economy (CE) state of maturity, the policy framework, and business opportunities in the UK. A thorough overview of current circular activities is given, while three sectors (buildings & infrastructure, manufacturing and waste management) are identified as being specifically promising industries for circular innovation from the Netherlands. Those sectors are examined more closely in form of three case studies, that include lessons learned of Dutch companies that have successfully entered these markets. The report was created by the Netherlands Enterprise Agency (RVO) in collaboration with the sustainability consultancy Useful Projects and NL Branding.

Government plans and legal landscape

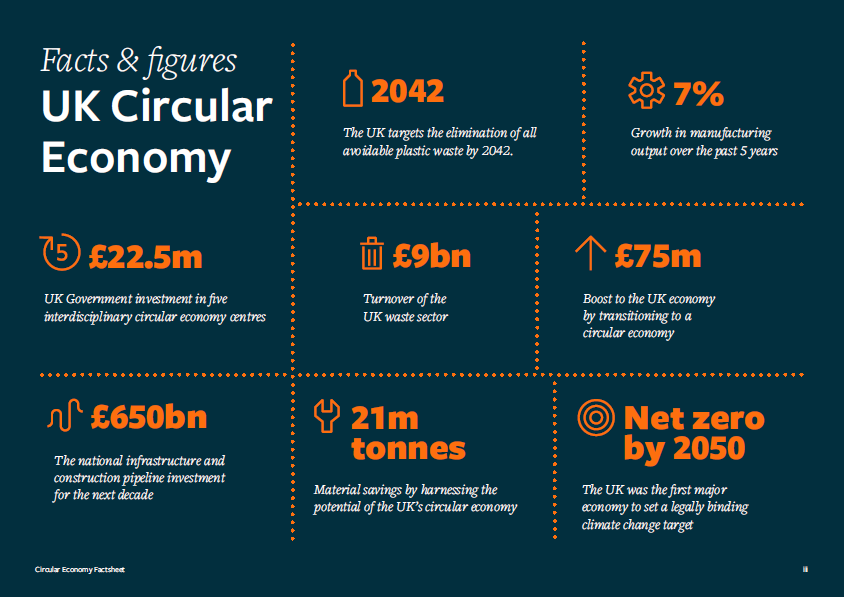

The United Kingdom was the first major economy to set a legally binding target to reach net-zero carbon emissions, and soon after brought policies and proposals on the way to accomplish the decarbonization of all industry sectors, including the EU Circular Economy Package (CEP) in 2020. It further plans to improve infrastructure, create jobs, boost innovation, and increase the adoption of circular practices (see ‘Build back better: our plan for growth’). The Environment Act, which came into effect in 2021 aims explicitly to incentivize recycling practices, more sustainable packaging, and reduced plastic waste exports to developing countries. The UK thus holds large potential for innovative front-runners in the circular economy industry, that can leverage existing experience in a new environment, help create a more resilient system, and reach net-zero in 2050.

Key sectors for circular development and best practices

Three UK key sectors were identified to be of particular interest to international circular economy experts: buildings & infrastructure (B&I), manufacturing, and waste management.

For each, the report offers a case study of Dutch SMEs that entered those respective industries in the UK, highlighting lessons learned about impacts, risks, and opportunities.

For B&I, StoneCycling, a Dutch company founded in 2012, transforms industrial and demolition waste into durable building material, and today finds the UK as its second-biggest market. In the report, their strategy to successfully introduce their products is explained, encompassing suitable activation campaigns and strong client relationship management.

Starke Energy entered the UK market in 2021, providing smart energy storage as a service to balance energy supply volatility in urban areas using AI. Through its smart storage capabilities, CO2 emissions can be reduced, and money can be saved within connected energy networks. Starke Energy partnered with local agencies and organizations to introduce their products and ensure legal compliance, and highly recommend these steps for a successful market entry.

In the waste management sector, N+P Group entered the UK already in 2007, turning non-recyclable waste into new raw materials and alternative fuels. Hereby, they keep materials in the loop that would otherwise end in landfills, and thereby reduce CO2 emissions and material depletion. The key success factor for N+P Group was to hire local staff as early as possible to understand differences in legislation and culture, and to build strong relationships with investors within the UK.