Circular economy opportunities in Nigeria

Nigeria’s population is one of the world’s fastest growing, set to surpass the USA’s population by 2050. This growth is coupled with an increased need for productivity in a sustainable manner, which can be achieved through the production and consumption principles of the circular economy. Evidence for the circular economy’s potential in Nigeria is reflected in its informal waste management sector that attracts operators due to the abundance of waste and a high demand for recycled materials, which offers a much valued economic incentive. Formalizing the informal waste management sector in Nigeria is only an initial step in realizing the country’s circular potential, a step in which Dutch expertise, coupled with the existing commitment from the Nigerian government and the private sector can render fruitful and lucrative outcomes for all parties involved.

Thinking about doing business in Nigeria? Below you will find information on policy landscape, circular economy strategy and selected priority areas!

Facts & Figures: Economic indicators

- Population (2019): 202 million

- Nominal GDP: USD 448 billion (ranking 26th worldwide)

- Purchasing power (2019) : USD 2,222

- Import from the NL 2019: EUR 5.2 billion

- Economic growth 2019: 2.27%

- Ease of doing business (2019): 131/190 (top 10 most improved)

- Corruption perception Index: rank 146/198

- Unemployment rate: 27%

- Currency: Nigerian Naira

- Time difference with NL: 0:00 hrs/- 1:00 hrs

Circular economy indicators

- Innovation Index rank: 117/ 131

- Municipal solid waste produced: 32 million tons/year

- Potential economic benefit from recycling: 11.71 million USD/year

- Potential emissions savings from recycling: 307 ktons/year

Figure: Municipal waste in Lagos State, LAMWA 2016

Policy landscape

Nigeria is part of several international treaties and multilateral environmental agreements, including Basel Convention, Montreal Protocol, and UN Climate Change Convention. The Federal Executive Council of Nigeria has recently approved a new law on plastic waste management. This legislation aims at developing a circular economy around plastic and financial institutions that support recycling initiatives in the country.

Extended producer responsibility (EPR)

EPR has been in the regulations since 2011. NESREA (on a federal level) and LASEPA (on Lagos State level) are responsible for monitoring and implementing EPR systems in Nigeria for different industries, including a $15 million fund for implementing circular economy approaches for the electronics sector. There are also EPR organizations representing industries that aim at implementing a functioning EPR system in Nigeria. For food and beverages this is the Food and Beverages Recycling Alliance (FBRA) and for E-waste this is the Extended Producer Responsibility Organization Nigeria (EPRON).

African Circular Economy Alliance (ACEA)

Nigeria is one of the founding members of the ACEA, which serves as a centralized platform for knowledge- sharing and best practices identification, the creation of enabling legal and regulatory frameworks, as well as building partnerships for financing and creation of circular economy projects in Africa.

Nigeria Circular Economy Working Group

A Nigeria circular economy working group (NCEWG) has been established by the Federal Government of Nigeria and the AfDB in which government, private sector and academics have a seat (Including NL CG in Lagos). The aim of the working group is to make a Circular Economy Roadmap for Nigeria.

Waste management in Nigeria

Nigeria produces more than 32 million tons of solid waste per year. The Lagos State Waste Management Authority (LAWMA) is responsible for solid waste management in Lagos, the country’s main economic powerhouse and home to 22 million inhabitants. The Lagos Recycling Initiative has recently been launched by LAWMA in order to further develop this community based approach that offers opportunities for the informal solid waste management sector in the city. LAWMA is investing in 20 community recycling centers around the state, as well as composting facilities, and a waste-to-energy facility. For Lagos, decentralizing recycling centers makes a lot of sense, since waste has been historically managed by local communities, and each of these communities is often still big enough to enjoy scale advantages.

Olusosun landfill 2019, by Freek van Eijk

Opportunities in the Nigerian waste management sector

- Partnering with Lagos State and the local private sector in building community recycling centers, transfer loading stations, blue/ green box initiative, composting facilities

- Waste to energy and off-grid solutions

- Waste purchasing and reintroduction to manufacturers as raw material or energy source

- Solutions for the bio-economy such as animal feed production, fertilizers, new bio-materials from agricultural byproducts

- Cooking oil recovery to biodiesel

- Ocean cleanup solutions

- RDF to power cement kilns

- PET recycling for breweries and other industries

- Recyclables trading and exporting

- E-waste recovery and storage facilities

- Battery recycling

Detailed opportunities in the Nigerian waste management sector can be explored in the Dutch scoping mission report.

We see four priority areas when it comes to circular economy opportunities and need: plastics, organic waste, electronics & EEEW, and fashion

Embassy of The Netherlands in AbujaPlastics

1.3 million tons of plastic waste is generated in Lagos alone every year. Currently only 10% is recycled. It is estimated that the increase of plastic recycling to 50%, can yield a $250 million return for the industry. Although both recycling companies and informal workers are collecting plastic waste, a huge amount still ends up in the ocean due to lack of collection. LAWMA’s Blue Box initiative as well as private initiatives such as Wecyclers and RecyclePoints are set out to enhance supply from households. Opportunities in this area include buying recycled plastics, application of Ocean Cleanup Interceptors, incineration of non-recyclables for industrial energy production, investments in PET recycling facilities and much more, knowing that the demand for recycled raw materials in Nigeria is higher than the current supply. A valuable partner for companies looking to make use of plastic waste in Nigeria, especially F&B packaging, is the Food & Beverage Recycling Alliance.

Nigeria 2019, by Freek van Eijk

Organic waste

Lagos on its own produces an estimate of 7,000 tons of organic waste daily (>40% of the city’s total waste). Organic waste supply is currently regularly provided by markets and food producers, and hopefully soon this will also be available from households via the Green Box initiative that is yet to be implemented. The demand side for organic waste is still virgin and full of opportunity. Opportunities vary, including separation of organic waste into a dry fraction (that can be incinerated for energy purposes) and a wet fraction (with high concentration of organics which is perfect for anaerobic digestion) using a Dutch pressure separation technique.

Another application under investigation by Dutch ‘New Generation Nutrition (NGN)’ is producing high protein animal feed from insects using organic waste as the main input. Organic waste generated upstream and early in the agricultural value chain, which is the country’s largest economic sector, can help prevent food waste and generate new and sustainable value streams using CE concepts. Partners in this area include Earthcare limited for composting and Nigerian Breweries (Heineken) for yeast drying.

Electronics & EEEW

Nigeria deals with over 1.1 million tons of e-waste annually, most of which is handled unprofessionally in a place called “New Garage” in the Ojota district in Lagos. A national program funded by the Global Environment Facility (GEF) has recently launched to implement a functioning EPR system for EEEW, which has triggered an increase of e-waste treatment and storage infrastructure. Business opportunities include collecting and recycling deep cycle batteries and setting up proper WEEE recycling lines for different products.

Recently, the Dutch social enterprise Closing the Loop was able to successfully conclude a pilot project concerning retrieving cobalt from lithium-ion mobile phone batteries sourced from Nigeria. They were able to source a total of 5,000 kg of batteries and sending them back to the Netherlands to be safely recycled, extracting an estimated 1,250 kg of cobalt that will be sold back to the market and used for new batteries, all accomplished in an economically viable manner and by providing work opportunities for the Nigerian collectors. Investments in this area are expected to increase as a result of the GEF program for supporting the EPR system. Notable partners for EEEW projects are E-Terra and Hinckley Group.

E-waste by Closing the Loop

Textiles

Imports of both used apparel and poor quality new apparel has been the main reason for the declining local textiles industry. It is estimated that 12% of the municipal waste produced in Lagos consists of textiles, which means that around 2,000 tons of textile waste is produced on a daily basis; most of which ends up in landfills. According to a feasibility study performed by Africa Collect Textile (ACT), the city of Lagos can benefit tremendously from a collection, re-use, and recycle system, which has proven to be technically and economically feasible. Advancements in textile recovery technologies, e.g chemical recycling, can offer a unique opportunity for a country like Nigeria. Building and investing in recycling facilities is usually only feasible when there is a constant source of input materials (i.e used clothes) and facilities to remanufacture the recovered materials. Initiatives such as the N100bn Textile and Garment (CTG) Intervention Fund managed and disbursed by the Bank of Industry (BOI), are in place to revamp the industry.

Upcoming events

See related items below.

Relevant networks

- Lagos State Waste Management Authority (LAWMA)

- National Environmental Standards and Regulations Enforcement Agency (NESREA)

- Food and Beverage Recycling Alliance of Nigeria (FBRA)

- Waste Management Society of Nigeria (WAMASON)

- Nigeria Climate Innovation Center (NCIC)

- African Circular Economy Network (ACEN)

- E-waste Producer Responsibility Organisation Nigeria (EPRON)

- Alliance for Responsible Battery Recycling (ARBR)

- FATE Foundation

- Lagos Business School Sustainability Center

- Lagos Chamber of Commerce and Industry (LCCI)

- Circular Economy Innovation Partnership (CEIP)

Embassies

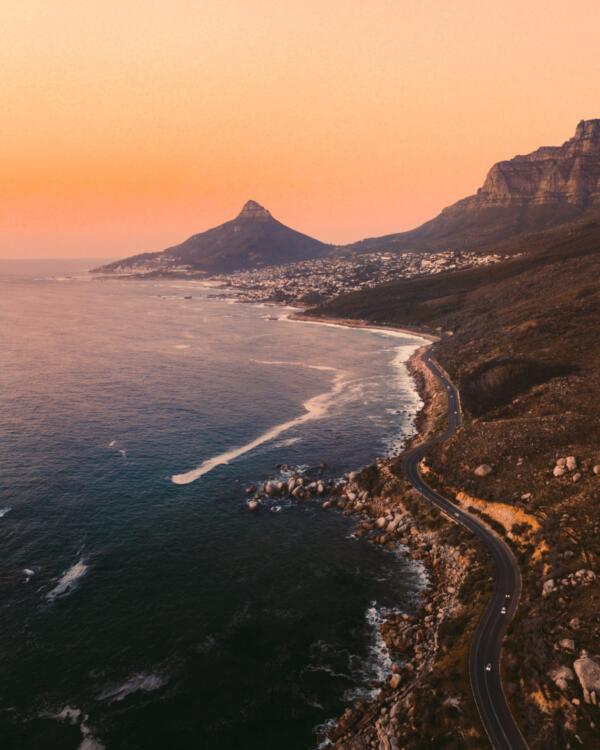

Trade Mission to South Africa

Johannesburg | Pretoria | Cape Town, South Africa | 15th until 20th of October 2023

Mission to South Africa with NL Ministers for Foreign Affairs & Agriculture

Lagos Circular Hotspot 2023: Leading the way in circular economy in Sub-Saharan Africa

Lagos launched Africa's Circular Economy 2023

Lagos Circular Economy Hotspot 2023

Lagos, Nigeria | 26th until 27th of July 2023

The first-ever Circular Economy Hotspot in Africa

Learnings: How hubs can drive sustainable development and innovation in the African continent?

Read the report 'Circular Economy Hubs Drive African Sustainability'

Circular Hotspots of the World: Driving the Global Movement

Helsinki, Finland / online | 1st of June 2023

A WCEF2023 Accelerator Session

Africa's Circular Journey, Unleashing the Power of Circular Economy Hubs

Helsinki, Finland / online | 1st of June 2023

A WCEF2023 Accelerator Session

Nordic, Dutch, and African hubs join forces for a circular economy

African, Nordics and Dutch foundations sign circular economy MOU

Trade mission Waste processing and Circular Economy to Egypt

Cairo, Egypt | 12th until 16th of March 2023

Discover opportunities in waste management in Egypt

Circular economy possibilities in South Africa

South Africa | 27th of September 2022

RVO will organize a meeting about the circular economy in South Africa.

CE Hotspot movement further pushing boundaries in 2024

In 2024 four CE Hotspot events around the globe will be organized

Will you host the 2024 Circular Economy Hotspot Event?

Host the 2024 Circular Economy Hotspot Event

NL International Business Day

KAS, De Bleek 13, 3447 GV Woerden | 9th of September 2022

Discover international business opportunities during the NL Business Day

Open Call for CE Hotspot 2024

Expression of interest for CE Hotspot 2024

Investment International Taskforce Africa meeting

The Hague, NL | 17th of May 2022

Promotion of Circular Economy in Africa!

Webinar on Water Management in Nigeria

Online | 6th of April 2022

A part of six webinar series on maximizing the value of water in Nigeria

WCEF2022

Kigali, Rwanda & Online | 6th until 8th of December 2022

For the first time, World Circular Economy Forum will be hosted in Africa!

SBIR call: Funding Opportunities to design and innovate with local materials in Africa

SBIR-Funding Opportunities for sustainable designers-innovators in Africa

The Circular Opportunity: African Stories Launch

online | 23rd of November 2021

An application that combines fun and education in Africa

Open Call for CE Hotspot 2023

Call for hosting the Circular Economy Hotspot 2023 opens

Launch of the Circular Business Platform Lagos

Discover the circular transition of Nigeria!

Launch of the Circular Business Platform Lagos (CBPL)

online | 5th of October 2021

Lagos platform initiative brings various stakeholders together

Circular Economy Seminar - Ghana

Accra, Ghana | 28th until 29th of October 2021

International seminar to promote EU-Ghana business partnerships

World Resource Forum 2021

12th until 14th of October 2021

"A Green Deal for Sustainable Resources."

Virtual Business to Business Matchmaking Event -Ghana

La Villa Boutique | online | 28th until 29th of September 2021

2-day programme to bring together Dutch and Ghanaian businesses

Africa Business Week

online | 25th until 28th of May 2021

Next steps to expand your business in Africa!

Kansenwebinar over afval en circulaire economie in Ghana en Nigeria

online | 11th of March 2021

Levert uw oplossing een bijdrage aan verbetering?

The benefits of a circular economy for achieving climate objectives and recovering better

online | 25th of February 2021

A pre-event of the WCEF+Climate

Circular Economy in Africa: 8 country reports

CE in Egypt, Ghana, Kenya, Morocco, Nigeria, Rwanda, Senegal & South Africa

Bluecon - Decentralized Small Scale Wastewater Solutions

Solutions which keep water circulating.

Join the Pipe - City Water

Filtered tap-water in a reusable bottle.

Launched: Country-Page Nigeria

2-pager with the most important information for doing business in Nigeria

Digital Africa Business Days

online | 15th until 16th of December 2020

Sustainable trade and investment between Africa and the Netherlands forum.

Lagos State Roundtable on Circular Economy

online, Nigeria | 2nd of December 2020

Leveraging Circular Economy for Rebuilding Lagos and Post COVID-19 Recovery

A scoping study on waste management and Circular Economy in the city of Lagos, Nigeria

Challenging, urgents needs for an overall waste and CE system improvement